Contents

- 1 Why Choose Proposal Software That Integrates with QuickBooks?

- 2 Features to Look for in Proposal Software That Integrates with QuickBooks

- 3 Key Benefits of Using Proposal Software That Integrates with QuickBooks

- 3.1 Streamlining Invoicing

- 3.2 Data Synchronization

- 3.3 Automating Quotes and Proposals

- 3.4 Tracking Proposal and Invoice Status

- 3.5 Custom Reporting and Analytics

- 3.6 Improving Cash Flow Management

- 3.7 Securing Client Data

- 3.8 Simplified Tax Calculations and Reporting

- 3.9 Enhanced Collaboration and Workflow

- 4 Getting Started with Proposal Software Integration with QuickBooks Online

- 5 Additional Resources

- 6 Conclusion

Managing finances can be a daunting task for many businesses, especially when manually entering data into different systems. For example, U.S. small businesses using 8 or more digital tools are nearly twice as likely to report revenue growth and three times more likely to expand their workforce than those using two or fewer tools.

Integrating with QuickBooks Online is a game changer for companies that rely on proposal software, automating everything from invoicing to data synchronization. In this blog, we’ll explore the benefits and steps to set up proposal software that integrates with QuickBooks, making financial workflows smoother and more efficient.

Why Choose Proposal Software That Integrates with QuickBooks?

Proposal software that integrates with QuickBooks Online simplifies your workflow by automating various financial and administrative tasks. Instead of manually transferring data between your proposal system and accounting software, this integration ensures seamless updates, reducing human error and saving valuable time.

Example: Imagine creating a proposal for a client, and once approved, the proposal details, such as pricing, taxes, and other financial data, automatically sync with QuickBooks Online. No more duplicate data entry or worrying about discrepancies between systems.

For instance, if your proposal includes a $5,000 service fee plus applicable taxes, that data will instantly populate into QuickBooks as an invoice. This ensures the client is billed accurately, payment terms are clear, and your accounts receivable reflect the most up-to-date information without any manual intervention.

Features to Look for in Proposal Software That Integrates with QuickBooks

-

Two-Way Data Sync

Look for software that offers seamless two-way data synchronization. This ensures that changes made in either the proposal system or QuickBooks are reflected in both systems.

Example: If a client requests a change in pricing after proposal approval, the updated information should automatically sync with QuickBooks without manual entry.

-

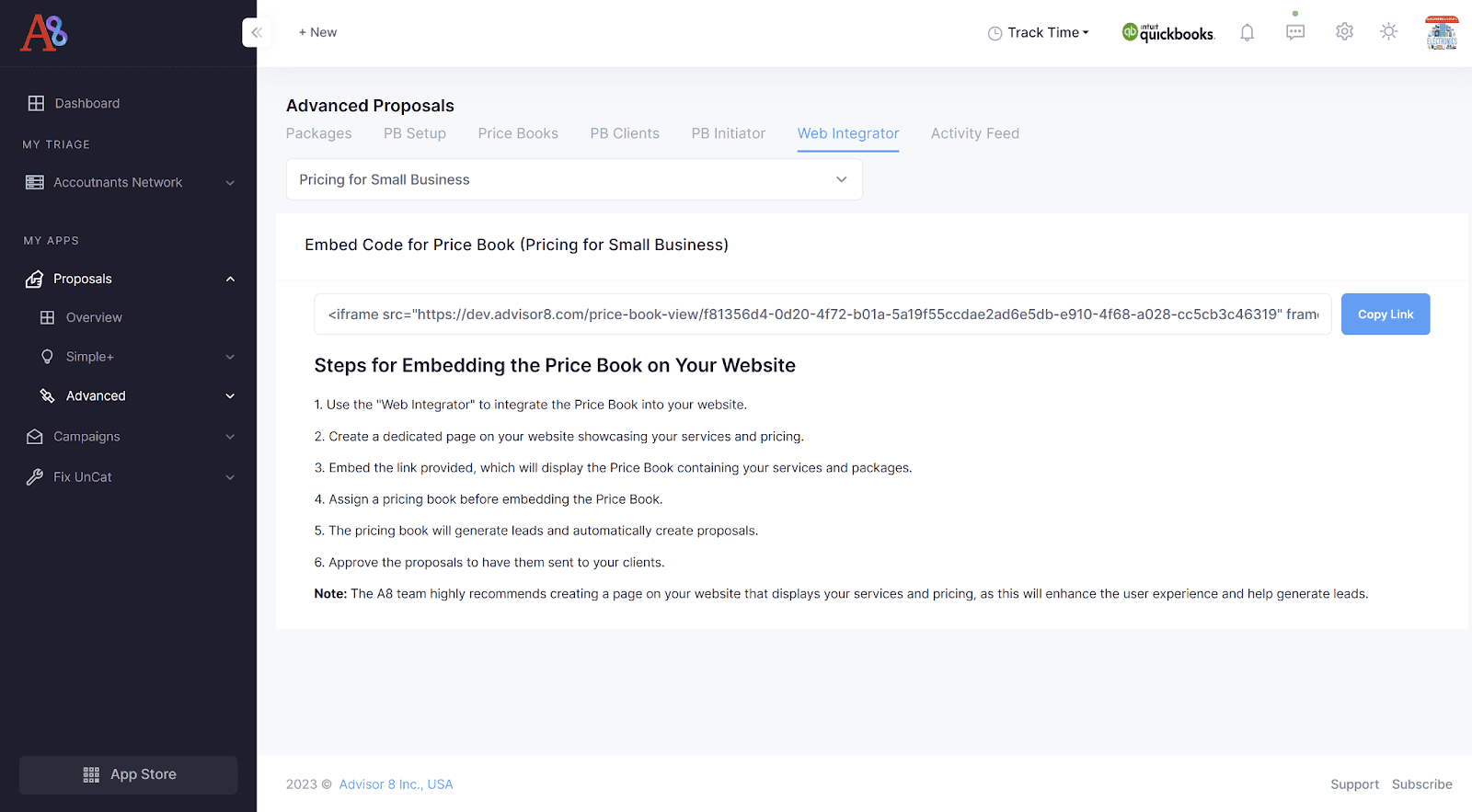

Customizable Templates and Automated Workflows

Choose proposal software with customizable templates and automated workflows that cater to your business needs. This allows you to create professional-looking proposals quickly while automating repetitive tasks like reminders and follow-ups.

Example: After sending a proposal, the software can schedule follow-up emails, track client interactions, and automatically sync payment terms with QuickBooks.

-

Integrations with CRM and Project Management Tools

Ensure your proposal software not only integrates with QuickBooks but also with your CRM and project management tools. This allows you to create a cohesive workflow, from client acquisition to project delivery and invoicing.

Example: A new project is added in your project management tool after a proposal is approved, and the project budget automatically syncs with both QuickBooks and your CRM.

-

Mobile Accessibility

In today’s business environment, having access to your proposal software on the go is a must. Look for software that offers mobile functionality so you can create, send, and approve proposals from anywhere while QuickBooks stays updated in real-time.

Example: A sales rep on the road can send a proposal from their smartphone and have it synced with QuickBooks, ensuring accurate financial tracking.

Also Read Quickbooks Desktop Discontinued: Everything You Need to Know!!!

Key Benefits of Using Proposal Software That Integrates with QuickBooks

Streamlining Invoicing

One of the greatest advantages of using proposal software that integrates with QuickBooks is how it simplifies invoicing.

- Automatically Create Draft Invoices: The software automatically generates draft invoices when a proposal is accepted. This eliminates manual data entry, reducing human error and speeding up the process.

- Approve and Manage Invoices Directly in QuickBooks: Once the draft invoice is created, you can approve it within QuickBooks. This integration ensures your finance team can manage all invoices from a single platform.

- Pull Existing Contacts from QuickBooks or Create New Ones: The software allows you to either pull in customer details from your QuickBooks database or add new contacts. This ensures that all customer information remains consistent and up-to-date across both systems.

For example, a digital marketing agency using proposal software that integrates with QuickBooks can quickly send accurate invoices to clients once they accept a proposal. This speeds up payment cycles and helps maintain cash flow.

Data Synchronization

Data consistency is vital to ensuring accuracy in your financial records. Here’s how proposal software that integrates with QuickBooks handles data synchronization:

- Sync Account Codes from QuickBooks to Proposal Line Items: The proposal software can pull in account codes from QuickBooks, ensuring that every line item in your proposal is correctly categorized for accounting purposes.

- Match Tax Codes: Synchronizing tax codes between your proposal software and QuickBooks ensures compliance and accuracy in tax calculations.

- Keep Customer Information Updated: As new customer data is entered into your proposal software, it automatically updates in QuickBooks, keeping records consistent across platforms.

Take, for example, an IT consultancy firm that needs to track various service categories for tax reporting. With proposal software that integrates with QuickBooks, all relevant tax information is updated in real time, ensuring that both proposals and invoices adhere to tax requirements.

Automating Quotes and Proposals

Integrating proposal software with QuickBooks also enhances the automation of quotes and proposals, significantly reducing manual workload.

- Generate Customized Quotes in QuickBooks: You can easily generate customized quotes within QuickBooks using data from your proposal software. This allows you to tailor quotes based on specific client requirements.

- Convert Quotes to Invoices Automatically: Once a quote is accepted, the proposal software converts it into an invoice in QuickBooks. This automation ensures no time is wasted on redundant data entry.

- Free Up Finance Teams by Reducing Manual Work: By automating repetitive tasks like quote generation and invoice creation, your finance team can focus on more strategic tasks, such as financial planning and analysis.

For instance, a construction company can use proposal software that integrates with QuickBooks to automate the entire process, from sending proposals to converting them into invoices, reducing manual interventions.

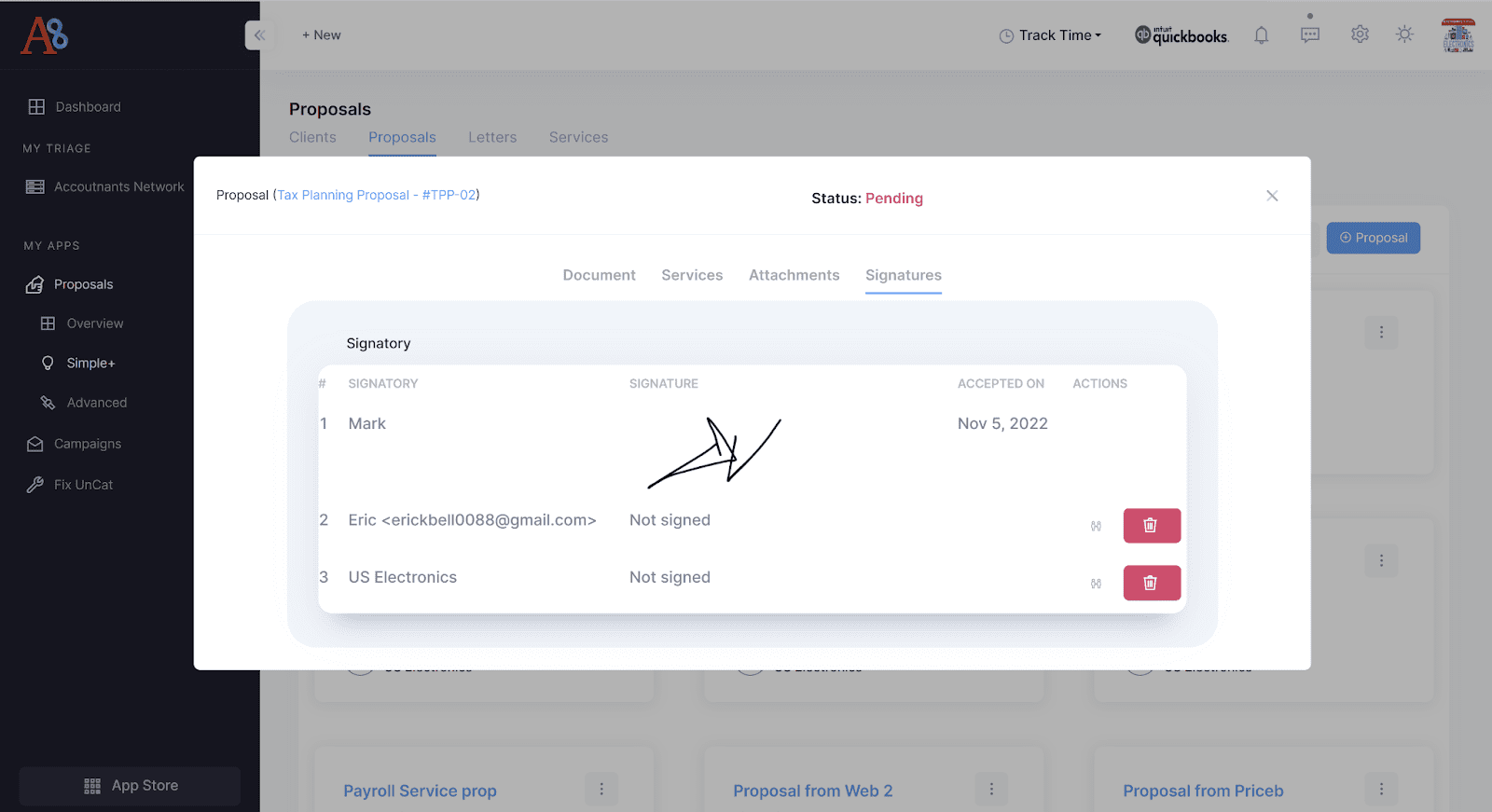

Tracking Proposal and Invoice Status

Monitoring the status of your proposals and invoices is crucial for timely payments and accurate financial reporting. Here’s how proposal software that integrates with QuickBooks helps streamline this process.

- View Proposal Acceptance and Invoice Payment Status: With real-time integration, you can easily track whether a proposal has been accepted or if an invoice is overdue.

- Set Automated Reminders: Proposal software integrated with QuickBooks can automatically send payment reminders to clients for overdue invoices, reducing the likelihood of late payments.

- Track Financial Performance: By syncing with QuickBooks, you can generate financial reports that track your company’s performance, including sales and outstanding invoices, helping with cash flow management.

For example, an event planning firm can use this integration to track the acceptance of event proposals and ensure that payments for services are received on time.

Custom Reporting and Analytics

In addition to improving invoicing and proposals, proposal software that integrates with QuickBooks allows for deeper financial insights through custom reporting.

- Generate Financial Reports: Use the integration to generate reports, such as profit and loss statements, that give you a clearer understanding of your company’s financial health.

- Analyze Proposal Success Rates: Track how many proposals turn into invoices and analyze your success rate. This data can help improve your proposal process and increase conversion rates.

- Create Customized Dashboards: Build custom dashboards in QuickBooks to monitor KPIs that are important to your business, such as sales trends or payment cycles.

For instance, a SaaS company can track how many software proposals turn into paid subscriptions and optimize future offerings accordingly.

Improving Cash Flow Management

Maintaining healthy cash flow is key to business success, and proposal software that integrates with QuickBooks can help in several ways.

- Monitor Payments in Real-Time: Integration allows you to see real-time updates on payments, ensuring you always have a clear picture of cash flow.

- Minimize Delays with Automatic Payment Links: Include automatic payment links in proposals or invoices, making it easy for clients to pay immediately.

- Forecast Future Cash Flow: The software can help forecast cash flow by analyzing outstanding invoices and expected payments.

For example, a freelance graphic designer can use this feature to track when clients are expected to pay, helping them plan for expenses.

Securing Client Data

Data security is a priority for any business. With proposal software that integrates with QuickBooks, you can ensure your client data is protected.

- Encrypted Data Transfer: Both platforms use secure, encrypted methods for data transfer, ensuring that your financial and client information stays safe.

- User Permissions and Access Levels: Set user permissions within the proposal software and QuickBooks, ensuring that sensitive financial data is only accessible to authorized personnel.

- Regular Backups: Integration with QuickBooks ensures that your data is backed up regularly, protecting you from potential data loss.

For example, a legal firm using this integration can have peace of mind knowing that sensitive client data is securely handled across both systems.

Simplified Tax Calculations and Reporting

For businesses dealing with complex tax rules, proposal software that integrates with QuickBooks ensures that all tax details are handled automatically. You can accurately apply sales tax to your proposals, which will be carried over to your QuickBooks account, making it easier to prepare for tax season.

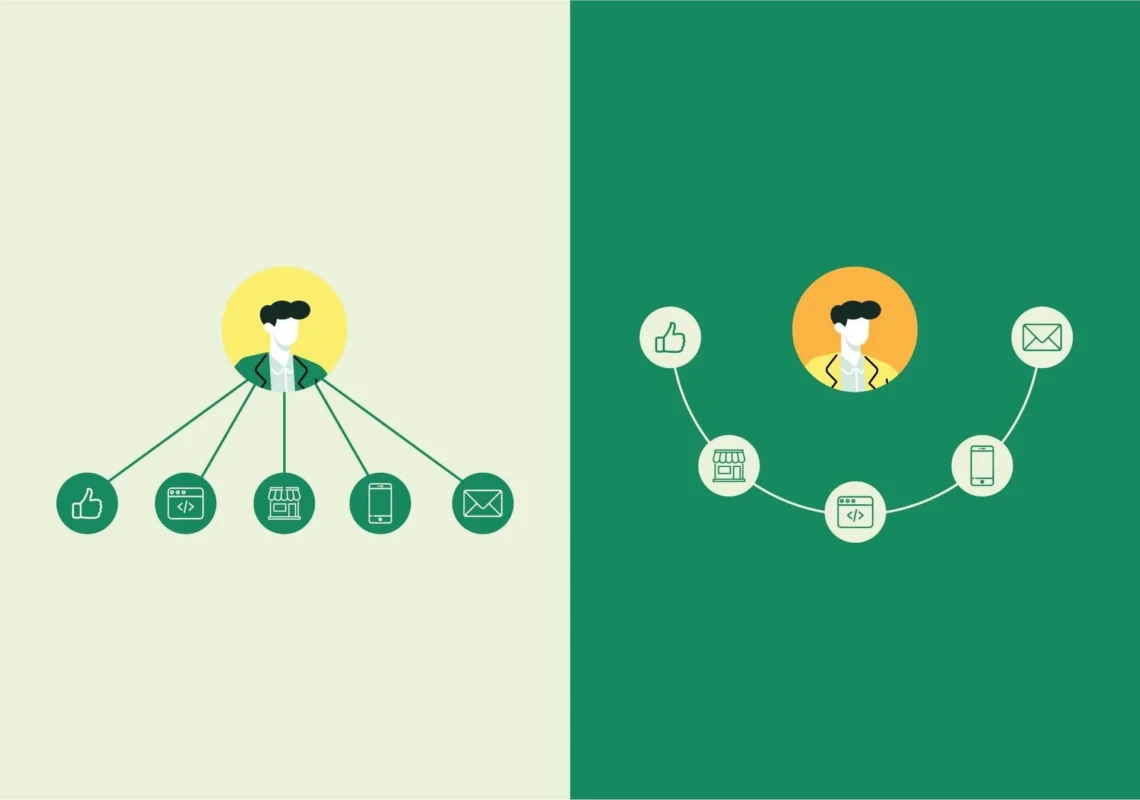

Enhanced Collaboration and Workflow

With this integration, different teams—such as sales, finance, and project management—can collaborate more effectively. Sales teams can focus on generating proposals without worrying about financial details, while finance teams can ensure all numbers are accurate and synced in real-time.

Example: A sales manager submits a $5,000 proposal, and the finance team instantly sees the relevant financial data reflected in QuickBooks, streamlining their review process.

Also Read: Quickbooks Sales Order Integration: Fixing Missing Sales Order

Getting Started with Proposal Software Integration with QuickBooks Online

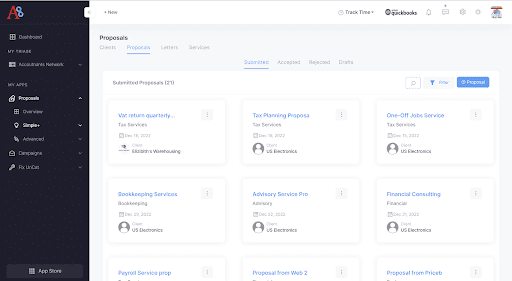

Integrating your proposal software that integrates with QuickBooks is straightforward and can significantly boost your productivity. Here’s how you can start.

- Enter the Proposal Software Application: Begin by logging into your chosen proposal software. Most modern software has intuitive user interfaces, allowing you to navigate through settings easily.

- Navigate to Settings > Integrations > QuickBooks Integration: After accessing the software, go to the “Integrations” section and select “QuickBooks” from the available options.

- Click the ‘Connect to QuickBooks’ Button: The process of linking your QuickBooks Online account to the proposal software is as easy as clicking a button. Look for “Connect to QuickBooks” and follow the prompts.

- Log in to Your QuickBooks Account: You will be redirected to the QuickBooks Online login page, where you will need to enter your credentials.

- Authorize the Software to Share Data with QuickBooks: After logging in, you will need to give the proposal software permission to access your financial data in QuickBooks. This ensures that the two platforms can automatically sync information like invoices, customer details, and payments.

Watch Here: Proposals – QuickBooks Online

Additional Resources

If you’re ready to explore the full benefits of proposal software that integrates with QuickBooks, consider these additional resources.

- Activate a Free Trial: Many software providers offer a free trial period, allowing you to test the integration and experience the benefits before committing to a subscription.

- Watch a Short Demo: Watching demo videos can help you better understand how the integration works and how it can be customized for your business needs.

- Access Resource Centers for Training and Education: Take advantage of tutorials and webinars offered by the software provider to ensure your team maximizes the integration’s benefits.

Conclusion

Integrating proposal software with QuickBooks is a smart move for businesses looking to streamline their financial processes. From automating invoicing and proposals to ensuring data synchronization across platforms, this integration enhances accuracy and efficiency in accounting workflows.

By leveraging these tools, companies can free up valuable time, reduce errors, and focus on growth.

However, if you are thinking of integration, WizCommerce is your go-to partner for seamless integration.

It is an all-in-one B2B e-commerce platform that stands out as a preferred choice for wholesalers, distributors, and manufacturers seeking to integrate their QuickBooks with proposal software.

With real-time data syncing and automated workflows, Wizcommerce integrates with QuickBooks, which not only makes life easier for finance teams but also improves client satisfaction by ensuring timely and accurate invoicing.

Whether you’re a startup or an established business, integrating your proposal software with QuickBooks is a step toward more efficient financial management.

Ready to see how Wizcommerce can seamlessly integrate your proposal software with QuickBooks? Book a demo now to discover how integrating it can transform your business operations.